WESTERN ALLIANCE BANK - BRIDGEBANK- ESCROW SYSTEM (Paying Agent Portal)

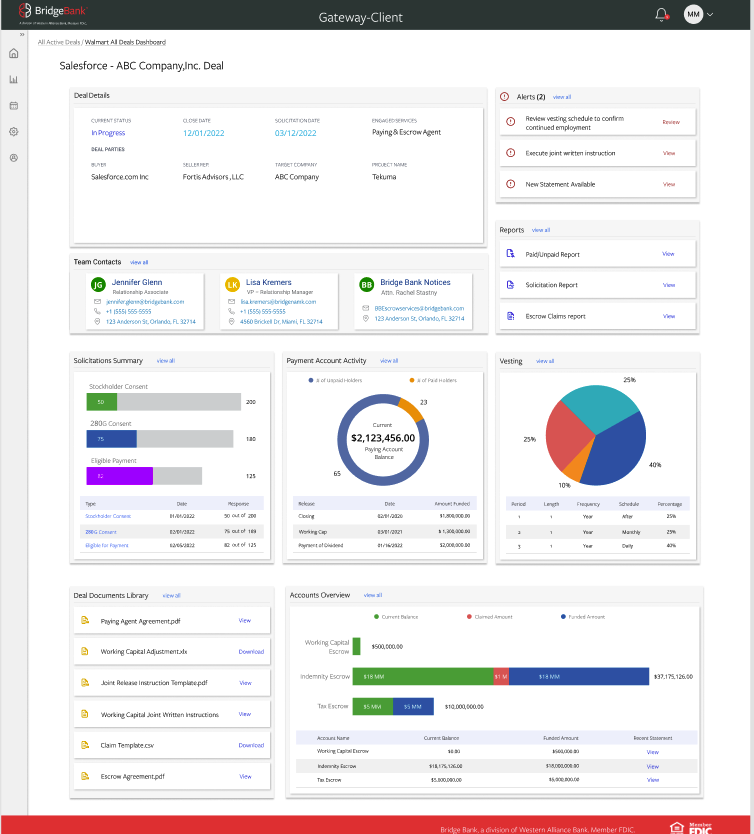

Developed a web based loan system management, paying agent management, and performance reporting dashboard applications. These application integrate with client legacy system and allows workers to perform their work in a moore efficient manner as well as allows supervisors and managers too see performance analytics

Problem Statement

Financial teams were struggling with clunky legacy systems that made loan management, paying agent tasks, and performance tracking inefficient. Frontline workers lacked streamlined tools, while managers had little visibility into team performance. There was a clear need for a modern, web-based solution that integrates with existing systems, boosts workflow efficiency, and delivers real-time performance insights.

My Role

I led the end-to-end design strategy for a modern loan and performance management solution, guiding research, prototyping, and usability testing to transform legacy workflows into a streamlined, user-centered web platform.

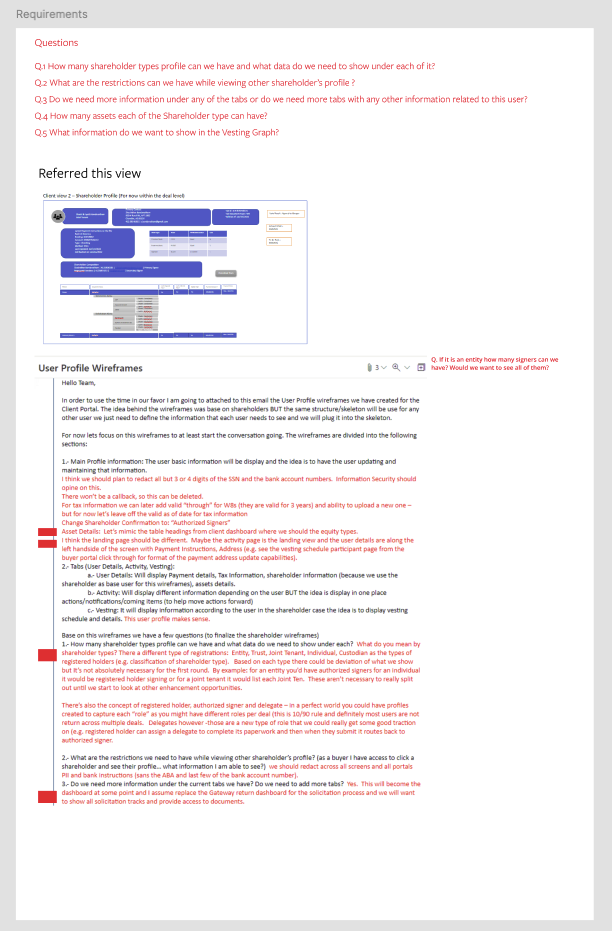

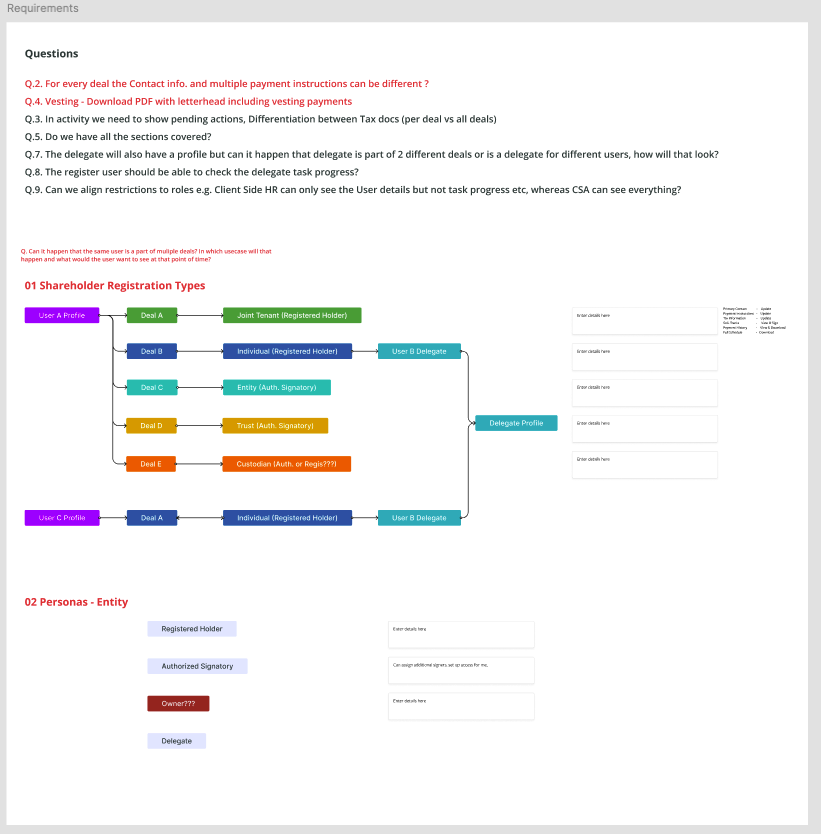

Conducted interviews, contextual inquiries, and surveys to understand pain points of frontline loan officers and finance managers.

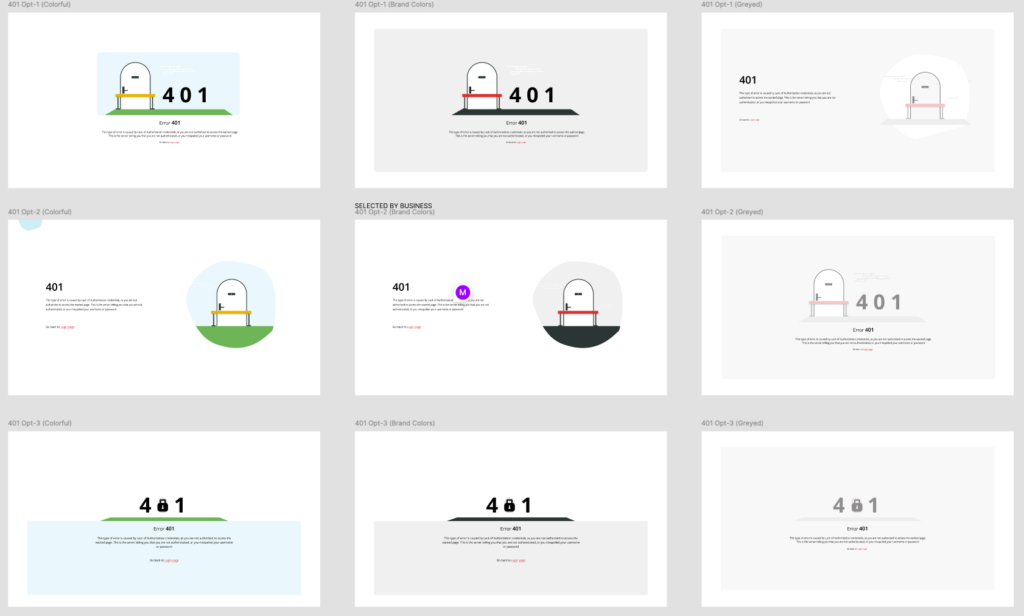

Defined key user workflows and designed iterative low- to high-fidelity prototypes that addressed fragmented processes and poor visibility.

Advocated for design systems, automation of repetitive tasks, and performance dashboards to improve both usability and operational insight.

Tools

- Figma

- HTML

- CSS

- Azure DevOps

- SharePoint

- Bootstrap

- Citrix

- FlowMapp

Research & Discovery

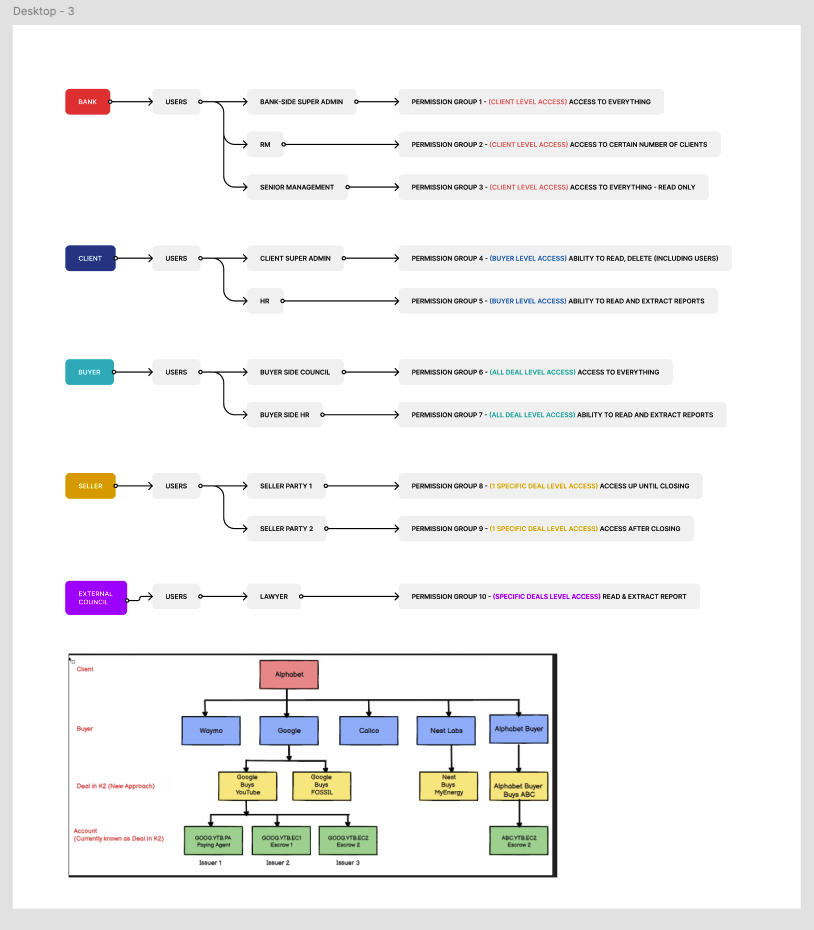

I conducted approximately 10 in-depth interviews with a mix of loan officers, paying agents, and their managers. These conversations helped map out their daily workflows, pain points, and needs. For example, I asked them to walk me through how they process a loan from start to finish, noting where they experienced frustration or delays.

I performed a heuristic UX audit of the existing software. This involved documenting the number of steps for common tasks, evaluating the consistency of the UI, and identifying usability issues (like unclear labels or lack of error messages). The audit confirmed that the system violated many UX best practices (for instance, important actions were buried in menus, and there was no feedback after completing a task, leaving users unsure if it was done correctly).

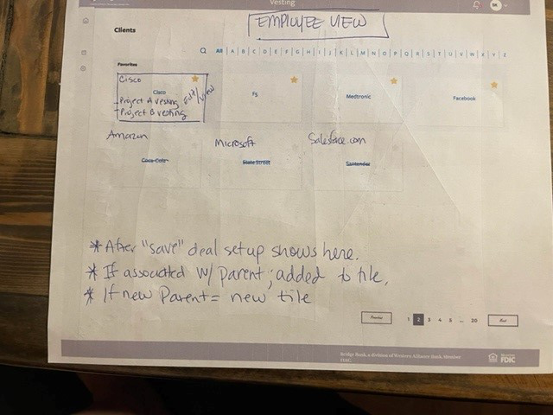

Ideation and Persona creation

I started by sketching user flows and wireframes on paper and whiteboards. I mapped out how a loan would move through the new system: from origination, to servicing, to payoff, including any paying agent touchpoints. The focus was on reducing steps and screens needed for each process.

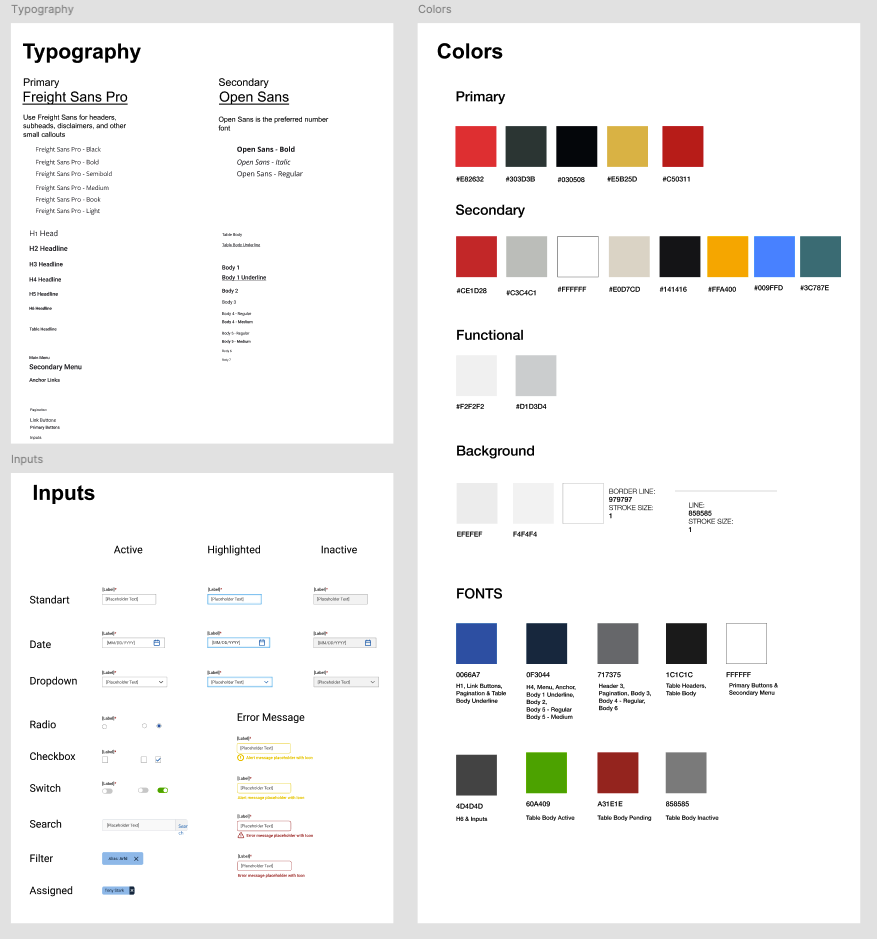

Design Systems

Goal was to develop a comprehensive design system that would:

- Ensure Consistency: Provide a unified visual and interaction language across the portal.

- Enhance Efficiency: Streamline the design and development process through reusable components.

- Facilitate Scalability: Support future growth and feature additions without compromising design integrity.

- Improve Collaboration: Serve as a single source of truth for designers and developers alike.

Documented variations in typography, color usage, button styles, and form elements.

Compiled detailed documentation outlining component usage, states, and behaviors.

Final Solution

Impacts & Learnings

The redesigned escrow services platform significantly streamlined operations, achieving a 25% improvement in internal operational efficiency. By reducing manual data-entry tasks through automated workflows and intuitive user interfaces, escrow officers reported fewer errors and faster transaction processing times. Moreover, usability testing revealed a 30% decrease in task completion time, directly translating into enhanced productivity and cost savings for the business. Client feedback post-launch was overwhelmingly positive, highlighting clearer communication and increased transparency through real-time status updates, resulting in improved client satisfaction and stronger relationships.

This project deepened my understanding of UX design within the financial sector, particularly around regulatory compliance and security requirements. Collaborating closely with cross-functional teams—developers, product managers, compliance officers, and business stakeholders—reinforced the importance of clear communication and flexibility in accommodating technical constraints while advocating for user needs.

One crucial learning was the value of iterative testing early in the design process. Frequent usability tests uncovered key insights, allowing rapid iterations and validating design assumptions effectively. This experience underscored that meticulous attention to user feedback and continuous stakeholder engagement are critical for delivering practical and impactful UX solutions in complex B2B environments. Moving forward, I aim to incorporate these collaborative and iterative practices into future projects, emphasizing a balance between business objectives, regulatory compliance, and seamless user experiences.